11 min read • Organization & transformation, Strategy

How to build and scale a multi-billion-dollar digital-first challenger brand

Building a brand used to be a time- and resource-intensive process. The need to invest and align marketing, distribution, manufacturing, and sales outlets meant it was purely the domain of large players with deep pockets and lengthy experience.

These high barriers to entry limited brand creation to existing FMCG players that had manufacturing facilities, relationships with retailers, distribution channels, and large marketing budgets.

However, the disruption caused by the internet, mobile, and digital, as well as the rise of new ancillary services (such as contract manufacturing and logistics), combined with changing consumer expectations, has turned this model on its head, creating a new category of digital-first challenger brands.

These new players can launch, market, distribute, and sell products in a more agile and cost-effective manner, tapping into a global market that is expected to reach over USD1.4 trillion by 2025, according to Euromonitor. Figures from Tracxn show that USD48bn has been invested since 2015 in over 4,157 funding rounds for challenger brands, many of which are seeing premium valuations. Chinese clothing company Shein was valued at USD64bn in March 2023, while razor brand Dollar Shave Club was bought by Unilever for USD1bn in 2016, just five years after it was founded.

However, digital brands face challenges due to market saturation, shrinking margins, and tighter access to funding. While they are cheap to start, they are harder to scale, with many finding it difficult to grow and reach long-term profitability. Given these issues, how can digital-first challenger brands thrive, and what can other brand owners learn from them?

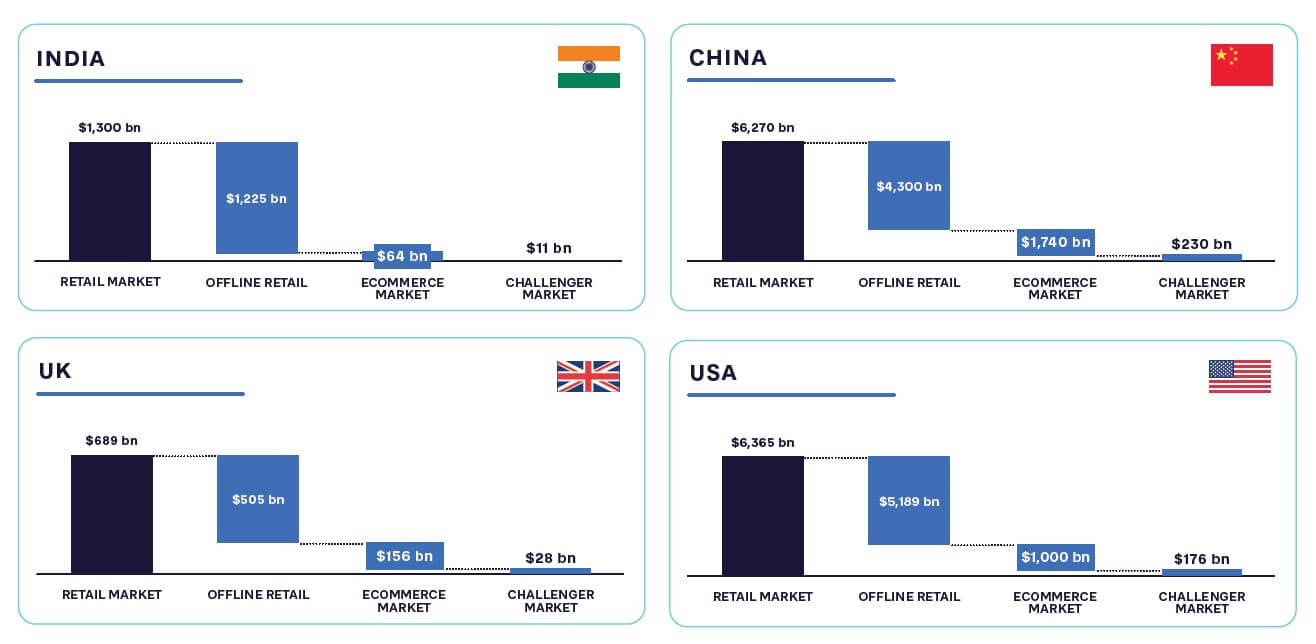

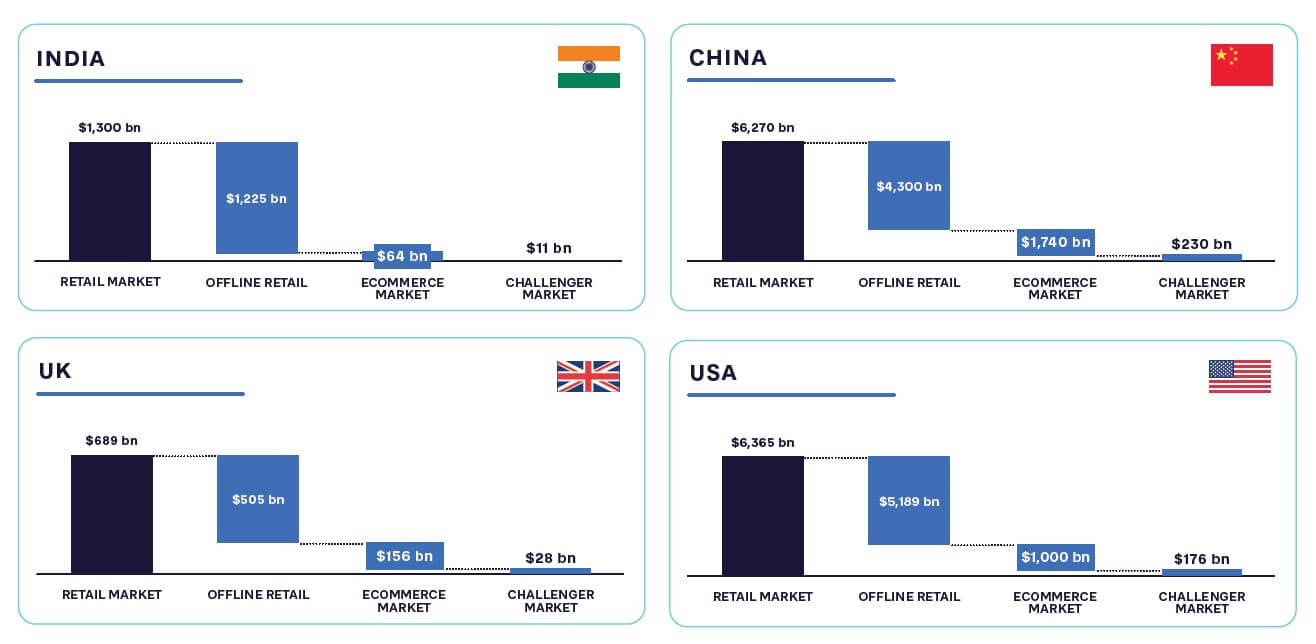

Figure 1 shows the market size of retail (USD bn), the online market, and the current opportunity captured by challenger brands. This highlights the size of the opportunity for challenger brands to grow and capture in retail.

The acceleration of brand creation

In the past, brands took years or even decades to become established. They were built on mastery of end-to-end processes controlled by the brand owner:

-

R&D/product creation to meet customer needs

-

Manufacturing within own facilities

-

Marketing/branding to stimulate demand from consumers and retail partners

-

Distribution/logistics delivering economies of scale

-

Long-term retail partnerships

-

Innovation to introduce new variants and build on the existing brand model

For example, Pepsi (founded 1965) solved issues around cold chain logistics with innovative packaging and formed partnerships with national bottlers to meet local needs and handle supply and distribution. Optimizing this model took decades and required a multi-million-dollar investment.

The rise of challenger brands

Four key factors have disrupted the existing brand value chain and enabled digital challenger brands to develop:

-

E-commerce, especially via smartphone and online marketplaces. Global online retail sales are expected to exceed USD7 trillion by 2025. This has removed the need for physical retail partnerships, replacing them with direct-to-consumer (D2C) channels.

-

Digital marketing channels such as social media, digital advertising, reviews, influencers, and SEO. This has lowered the costs and time needed to create marketing campaigns, with better attribution enabling more agile, targeted spend.

-

Changing consumer expectations, leading to an increasing desire for personalization, convenience, and novelty creating willingness to try new brands and products.

-

The growth of ancillary services such as third-party logistics and contract manufacturing. Brands now don’t have to own their own factories or build a supply chain, as partners such as Shopify (an e-commerce platform providing services for brands) and Shipstation (shipping and fulfillment) enable fast expansion into multiple markets/geographies.

What are the components of a successful challenger brand?

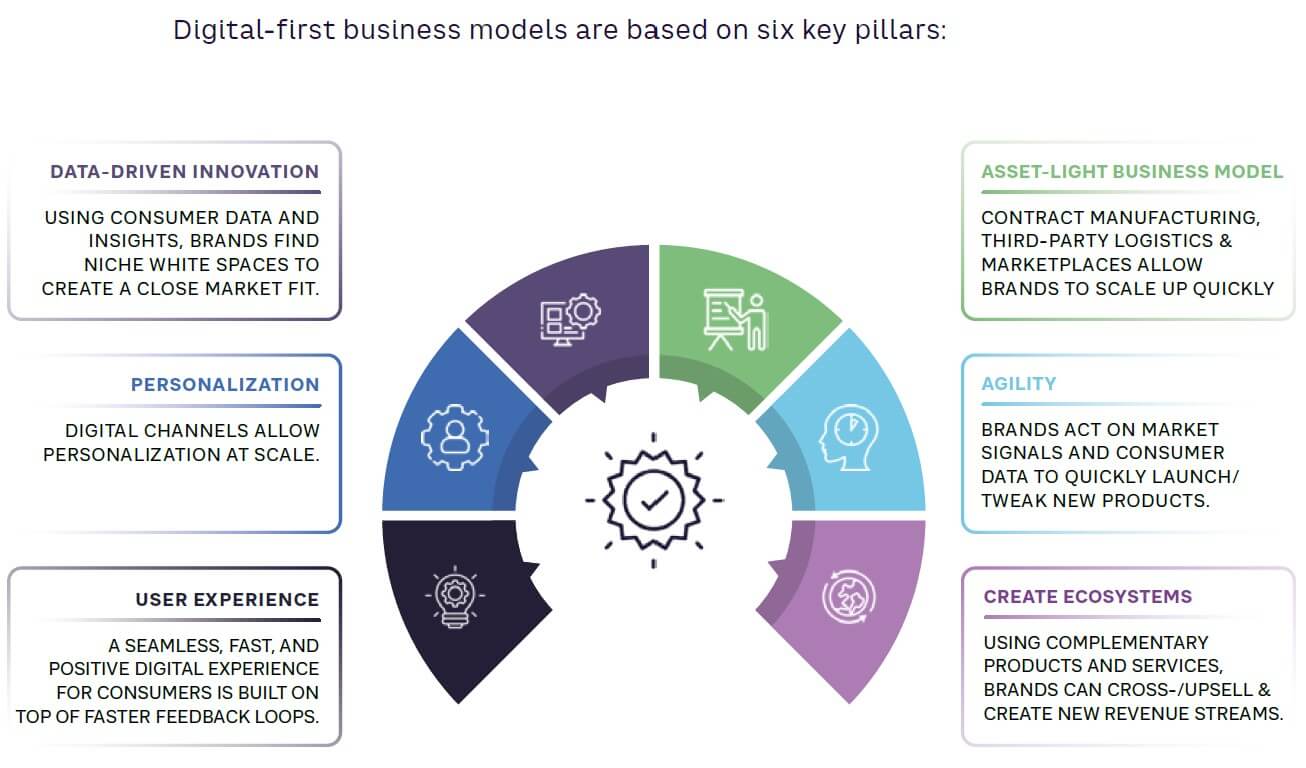

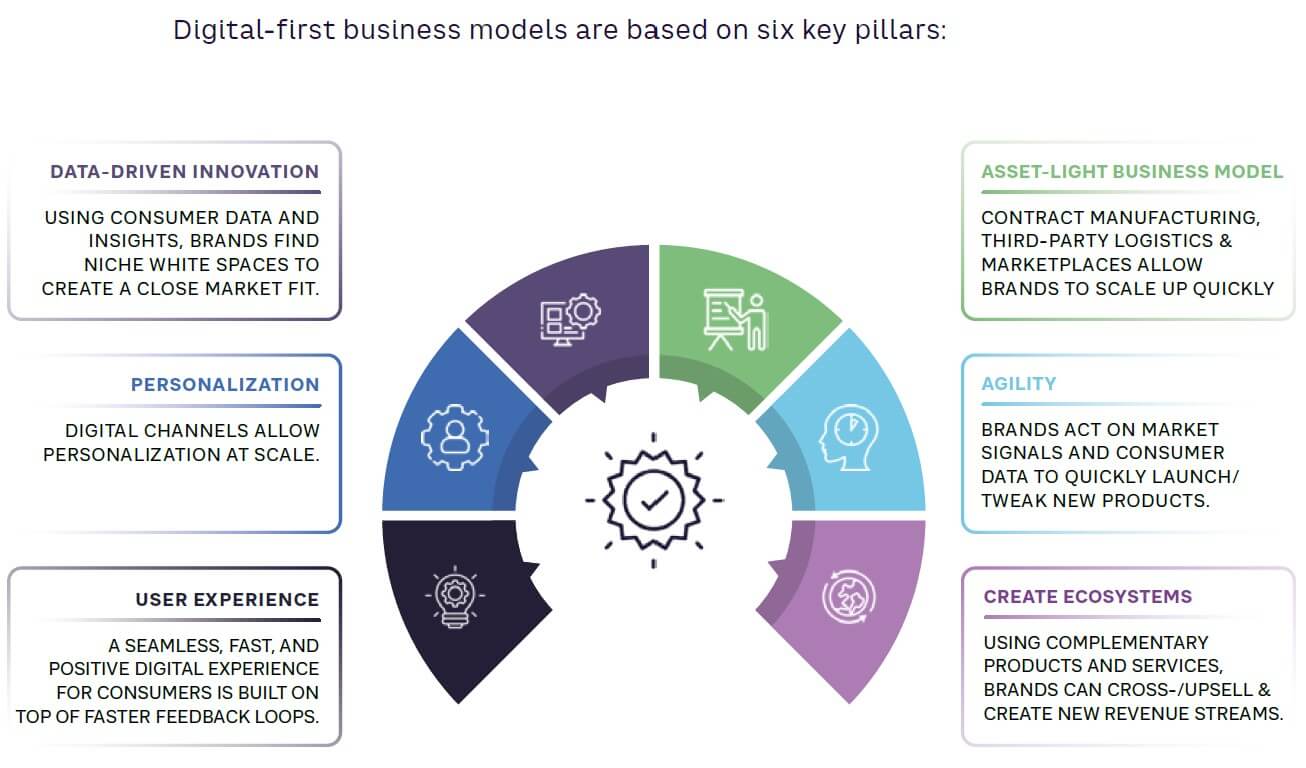

Digital-first business models are based on six key pillars:

1. User experience

Brands create a seamless, fast, and positive digital experience for consumers, investing heavily in innovation such as the Metaverse and AI. For example, glasses brand Warby Parker offers a virtual try-on tool for users in conjunction with SnapChat, while e-grocery brands promise the convenience of 30-minute delivery. The user experience is continually improved through fast feedback loops based on consumer reviews and constant testing of new features.

2. Data-driven innovation

By using consumer data and insights, challenger brands find and target niches/white spaces, creating a close market fit. Showing the extent of this approach, Indian brand The Sleep Company has created a smart mattress that incorporates sensors to track sleep patterns. These insights are then used to drive product development.

3. Personalization

Consumers increasingly want a personalized experience, not just a standard product. Digital channels and technology allow this to be delivered at scale. For example, Indian brand Fable Street provides workwear for women, tailored specifically for their shape and size using its proprietary Tailored Fit Algorithm.

4. Agility

Challenger brands are focused on acting on market and consumer data to quickly launch new products into new and existing markets. Shein produces smaller volumes of individual clothing products, but offers an enormous, fast-changing range, releasing 6,000 new items every day. Platform approaches support this agility. For example, Chinese smartphone company Xiaomi entered India via a partnership with e-commerce platform Flipkart and captured 11 percent of the market within two years.

5. Asset-light business models

Through contract manufacturing, third-party logistics (3PL), and marketplaces (such as Amazon) for sales, challenger brands can operate extremely efficient, asset-light business models. For example, glasses brand Lenskart has outsourced manufacturing, enabling it to focus on product design, marketing, and customer engagement.

6. Create ecosystems

By offering complementary products and services, challenger brands can cross-/upsell and create new revenue streams. Amazon began as an online bookstore and has expanded into smart home, music/entertainment, and cloud computing, for example. UK fitness clothing brand Gymshark now offers virtual training sessions, health supplements, and workout gear, creating a comprehensive fitness ecosystem.

Innovation in digital-first business models – lessons for all brands

Challenger brands have pioneered four main business models that can potentially be adopted by other companies.

1. Subscription

Offering products and services on a recurring basis allows brands to create predictable revenue streams and build long-term customer relationships. Customers value the combination of convenience and personalized experience brands deliver based on data analysis. Meal kit providers such as Blue Apron, Gousto, and Eat Fit all deliver pre-measured ingredients and recipes to customers, avoiding the need to shop and reducing food waste, for example. Subscription models also support other revenue streams, including website advertising, affiliate partnerships, and data sales.

2. House of Brands

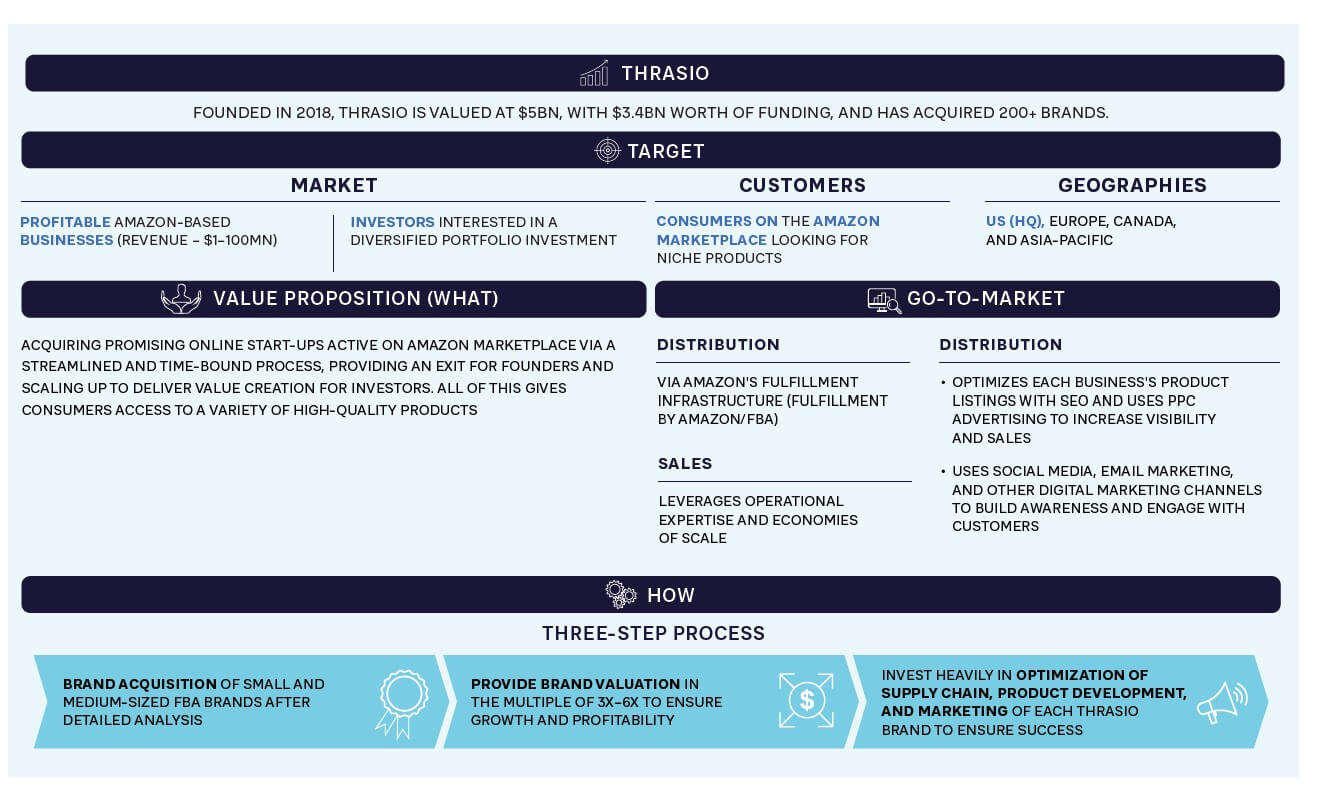

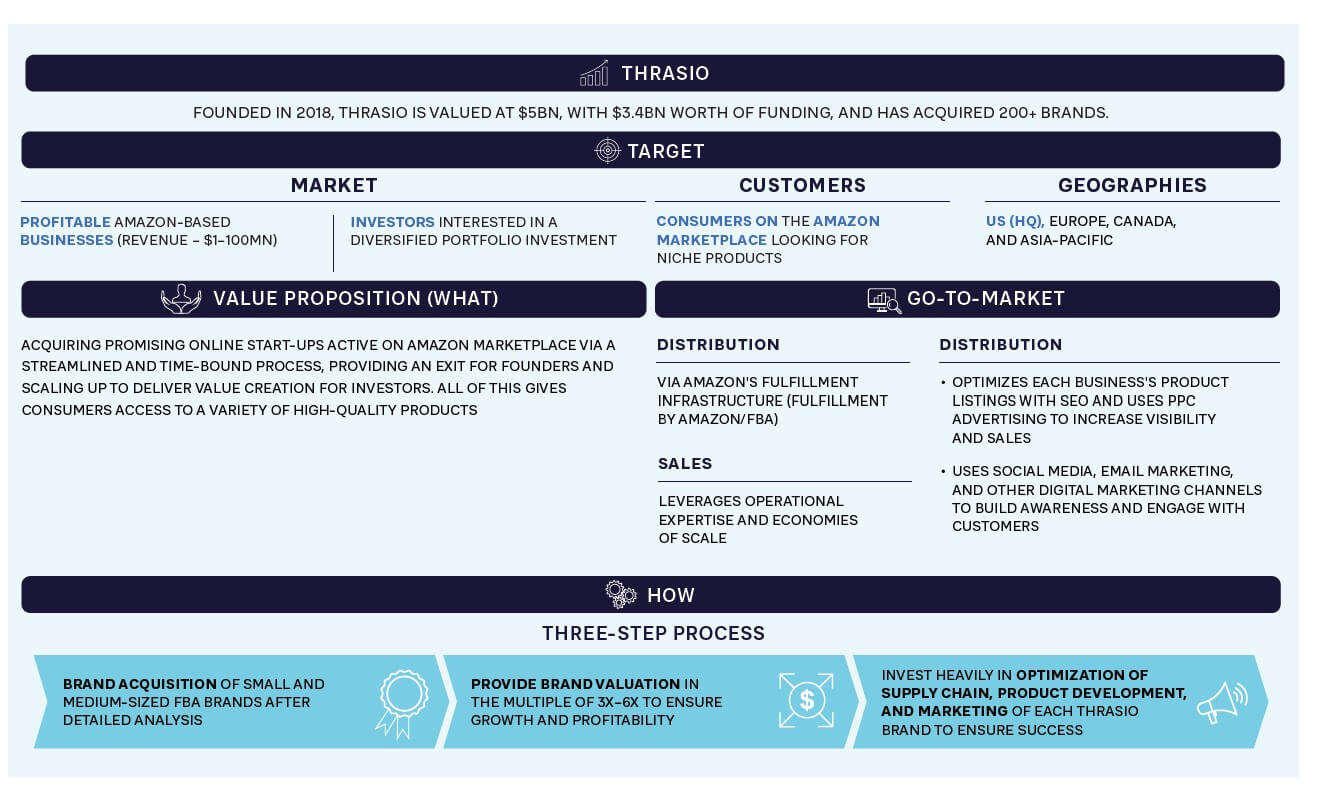

This approach minimizes overheads (such as customer service costs), creates supply-side synergies, and achieves scale through a single company offering a range of distinct brands targeting different consumer segments. Essentially, it is the digital equivalent of an FMCG brand company such as P&G or Unilever, with leaders including Thrasio in the US and India’s Mensa Brands, which achieved unicorn status in under a year. Success requires careful management and coordination to maintain each brand’s unique identity and positioning while achieving synergies. Figure 3 provides more details on Thrasio’s approach.

3. Hyperlocal channels

Hyperlocal brands focus on serving a specific geographic area, typically within a few miles, to provide personalized and community-oriented products or services, from food and grocery to laundry. They deliver products ultra-quickly and use data to understand and meet the needs of their customers. Currently many of these brands (such as Deliveroo, Instamart, and TaskRabbit) are investing heavily to improve their efficiency and scale services to meet a market predicted to reach USD4,681.3 million by 2030 from USD1,344.7 million in 2021.

4. Curated marketplace

To expand their reach and leverage their customer base, many challenger brands are creating their own curated marketplaces. These enable other brands to sell their products, attracting more regular visitors and diversifying revenues. For example, shoe company Allbirds has added a commission-free marketplace to its site, offering customers other sustainable fashion products from third-party sellers.

A framework for building and scaling a challenger brand

All start-ups currently face issues around securing funding, as described in How to build a unicorn in the post-pandemic inflationary world (Prism S1 2023). Challenger brands also need to overcome potential market saturation and meet fast-changing consumer requirements. Based on our experience and discussions with brands and investors, we recommend this framework to enable success:

1. Build trust and a strong brand

Social media means feedback is instant and spreads virally. Building trust is crucial for brands, but challenging due to the crowded digital marketplace, lack of physical presence, and limited customer attention span. To create trust, challenger brands should focus on:

-

Developing a clear brand identity that reflects their values and mission to differentiate from rivals

-

Providing excellent customer service to build trust and loyalty

-

Engaging with customers regularly through digital platforms to build community and address negative comments

-

Leveraging influencers and partnerships to reach a wider audience and build credibility

For example, Indian beauty products brand Sugar builds strong trust with millennials by offering make-up products with colors suited to the Indian skin tone that can last a full day in the country’s tropical climate.

“Being vocal about the company’s story and purpose is crucial in building consumer trust and avoiding price competition,” Founder, personal care D2C challenger brand

2. Be data driven without compromising security and data privacy

Consumers are increasingly concerned about how their personal data is being used, and want to do business with companies that take their privacy seriously. Brands should follow these data management practices:

-

Collect only necessary data

-

Use secure storage and robust data management practices

-

Obtain explicit consent from consumers around data uses

-

Provide transparency about data collection and usage

-

Regularly review and update security measures

For example, UK clothing brand ASOS has published a clear data privacy policy and achieved ISO 27001 certification to reassure customers.

3. Focus on profitability to overcome the macroeconomic outlook

Many D2C challenger brands benefited from the switch to digital channels and the closure of shops during the pandemic. The partial shift back to physical commerce has increased pressure around profitability. Investors are now more cautious about funding unprofitable growth, leading to brands pulling out of certain geographic areas. Digital-first brands therefore need to:

-

Focus on profitability rather than simply user acquisition

-

Create sustainable revenue streams, deliver operational efficiency, and differentiate their products/services

-

Apply selective growth strategies, focusing on profitable markets/channels rather than rapid expansion at all costs

“Amazon advertising may not be cheap, but it’s still more cost-effective than establishing physical stores or limiting ourselves to our own marketplace,” Founder, consumer electronics challenger brand

4. Stay competitive in markets where barriers to entry are low

Digital-first brands have lower profit margins than traditional retailers, with an average of 4.6 percent versus 11.6 percent, respectively. Increased price competition further hits margins, while low switching costs make it difficult to retain customers. Challenger brands therefore should:

-

Create a unique value proposition

-

Build a strong brand identity and messaging

-

Leverage technology to improve the customer experience

-

Collaborate to build new revenue streams

-

Continuously innovate and evolve their offering

“Contract manufacturing and transitioning to organized retail allowed us to invest in brand building and expand into different regions,” Founder, personal care D2C challenger brand

5. Focus on innovation and agility

In a volatile world, brands must be flexible and respond to changes in customer preferences to remain competitive. Owning R&D of products gives the brand flexibility to innovate and develop unique products quickly. For example, mCaffeine, a coffee-based beauty products brand from India, owns its product R&D and launches innovative products regularly. Social media platforms frequently introduce new features or algorithms, requiring brands to quickly adapt their digital marketing strategies, while consumer preferences can change overnight. Brands therefore need to:

-

Be data driven and pivot quickly, such as by opening physical stores

-

Own product R&D and embrace a culture of experimentation

“We prioritize using a launch-and-test approach over aiming for a perfect product from the start,“ Founder, challenger coffee brand

6. Ensure a consistent user experience across all touchpoints

As brands expand, inconsistency across touchpoints can lead to customer confusion and erode trust. This is a particular issue as companies rapidly add different channels, platforms, and markets while still being small in terms of size/employees. To mitigate this issue, challenger brands must:

-

Establish a consistent brand identity across all touchpoints

-

Align messaging and branding with target audiences

-

Provide a consistent user experience across all touchpoints

-

Train employees on brand values and ensure they can seamlessly convey them to customers

“As investors, we look for if the brand has ethos in its product development around uniqueness, scalability, and efficaciousness,” Managing Partner, Amicus Capital

7. Adopt new tactics to scale beyond tier 1 markets

Tier 1 cities provide a combination of savvy consumers, straightforward logistics, and digital infrastructure, making them the traditional starting point for challenger brands. However, they are now saturated and highly competitive, meaning brands need to scale beyond them and embrace smaller/emerging markets. This means overcoming challenges such as limited access to digital devices and internet connectivity, lack of trust in online transactions, and concerns around security. Brands therefore must:

-

Launch targeted marketing campaigns to address the concerns and needs of consumers in tier 2/tier 3 cities

-

Adapt business models and offerings to cater to local preferences and go omnichannel. For example, Harry’s Razors moved from being solely D2C to selling in Target (US) and Boots (UK), while FabIndia opened physical stores, especially in tier 2/3 cities

-

Provide more flexible payment and delivery options, such as cash on delivery and pickup points

-

Partner with local businesses and influencers to build credibility with consumers

-

Invest in digital infrastructure and logistics to overcome operational challenges

“Most of the companies in our portfolio are witnessing massive growth from tier 2 cities, showcasing the need to focus on such underserved market segments,” Managing Partner, Amicus Capital

Insights for the executive

For larger brand houses

-

Create your own digital brands: Create your own digital-first brand to launch new and innovative products, and aim to occupy white spaces in the landscape.

-

Partner with challenger brands: Partner with challenger brands to create ecosystem synergies and benefits from respective competencies.

-

Invest through corporate venture capital (CVC): Set up a CVC arm to invest in upcoming challenger brands.

-

Launch a sandbox for fostering innovation: Identify and build in relevant categories that will benefit the parent brand.

For investors

-

Set up dedicated expert teams for building challenger brands: Develop novel themes for investment and provide guidance on business model innovations and opportunities.

-

Establish accelerator programs: Set up accelerator programs to incubate early-stage start-ups.

11 min read • Organization & transformation, Strategy

How to build and scale a multi-billion-dollar digital-first challenger brand

DATE

Building a brand used to be a time- and resource-intensive process. The need to invest and align marketing, distribution, manufacturing, and sales outlets meant it was purely the domain of large players with deep pockets and lengthy experience.

These high barriers to entry limited brand creation to existing FMCG players that had manufacturing facilities, relationships with retailers, distribution channels, and large marketing budgets.

However, the disruption caused by the internet, mobile, and digital, as well as the rise of new ancillary services (such as contract manufacturing and logistics), combined with changing consumer expectations, has turned this model on its head, creating a new category of digital-first challenger brands.

These new players can launch, market, distribute, and sell products in a more agile and cost-effective manner, tapping into a global market that is expected to reach over USD1.4 trillion by 2025, according to Euromonitor. Figures from Tracxn show that USD48bn has been invested since 2015 in over 4,157 funding rounds for challenger brands, many of which are seeing premium valuations. Chinese clothing company Shein was valued at USD64bn in March 2023, while razor brand Dollar Shave Club was bought by Unilever for USD1bn in 2016, just five years after it was founded.

However, digital brands face challenges due to market saturation, shrinking margins, and tighter access to funding. While they are cheap to start, they are harder to scale, with many finding it difficult to grow and reach long-term profitability. Given these issues, how can digital-first challenger brands thrive, and what can other brand owners learn from them?

Figure 1 shows the market size of retail (USD bn), the online market, and the current opportunity captured by challenger brands. This highlights the size of the opportunity for challenger brands to grow and capture in retail.

The acceleration of brand creation

In the past, brands took years or even decades to become established. They were built on mastery of end-to-end processes controlled by the brand owner:

-

R&D/product creation to meet customer needs

-

Manufacturing within own facilities

-

Marketing/branding to stimulate demand from consumers and retail partners

-

Distribution/logistics delivering economies of scale

-

Long-term retail partnerships

-

Innovation to introduce new variants and build on the existing brand model

For example, Pepsi (founded 1965) solved issues around cold chain logistics with innovative packaging and formed partnerships with national bottlers to meet local needs and handle supply and distribution. Optimizing this model took decades and required a multi-million-dollar investment.

The rise of challenger brands

Four key factors have disrupted the existing brand value chain and enabled digital challenger brands to develop:

-

E-commerce, especially via smartphone and online marketplaces. Global online retail sales are expected to exceed USD7 trillion by 2025. This has removed the need for physical retail partnerships, replacing them with direct-to-consumer (D2C) channels.

-

Digital marketing channels such as social media, digital advertising, reviews, influencers, and SEO. This has lowered the costs and time needed to create marketing campaigns, with better attribution enabling more agile, targeted spend.

-

Changing consumer expectations, leading to an increasing desire for personalization, convenience, and novelty creating willingness to try new brands and products.

-

The growth of ancillary services such as third-party logistics and contract manufacturing. Brands now don’t have to own their own factories or build a supply chain, as partners such as Shopify (an e-commerce platform providing services for brands) and Shipstation (shipping and fulfillment) enable fast expansion into multiple markets/geographies.

What are the components of a successful challenger brand?

Digital-first business models are based on six key pillars:

1. User experience

Brands create a seamless, fast, and positive digital experience for consumers, investing heavily in innovation such as the Metaverse and AI. For example, glasses brand Warby Parker offers a virtual try-on tool for users in conjunction with SnapChat, while e-grocery brands promise the convenience of 30-minute delivery. The user experience is continually improved through fast feedback loops based on consumer reviews and constant testing of new features.

2. Data-driven innovation

By using consumer data and insights, challenger brands find and target niches/white spaces, creating a close market fit. Showing the extent of this approach, Indian brand The Sleep Company has created a smart mattress that incorporates sensors to track sleep patterns. These insights are then used to drive product development.

3. Personalization

Consumers increasingly want a personalized experience, not just a standard product. Digital channels and technology allow this to be delivered at scale. For example, Indian brand Fable Street provides workwear for women, tailored specifically for their shape and size using its proprietary Tailored Fit Algorithm.

4. Agility

Challenger brands are focused on acting on market and consumer data to quickly launch new products into new and existing markets. Shein produces smaller volumes of individual clothing products, but offers an enormous, fast-changing range, releasing 6,000 new items every day. Platform approaches support this agility. For example, Chinese smartphone company Xiaomi entered India via a partnership with e-commerce platform Flipkart and captured 11 percent of the market within two years.

5. Asset-light business models

Through contract manufacturing, third-party logistics (3PL), and marketplaces (such as Amazon) for sales, challenger brands can operate extremely efficient, asset-light business models. For example, glasses brand Lenskart has outsourced manufacturing, enabling it to focus on product design, marketing, and customer engagement.

6. Create ecosystems

By offering complementary products and services, challenger brands can cross-/upsell and create new revenue streams. Amazon began as an online bookstore and has expanded into smart home, music/entertainment, and cloud computing, for example. UK fitness clothing brand Gymshark now offers virtual training sessions, health supplements, and workout gear, creating a comprehensive fitness ecosystem.

Innovation in digital-first business models – lessons for all brands

Challenger brands have pioneered four main business models that can potentially be adopted by other companies.

1. Subscription

Offering products and services on a recurring basis allows brands to create predictable revenue streams and build long-term customer relationships. Customers value the combination of convenience and personalized experience brands deliver based on data analysis. Meal kit providers such as Blue Apron, Gousto, and Eat Fit all deliver pre-measured ingredients and recipes to customers, avoiding the need to shop and reducing food waste, for example. Subscription models also support other revenue streams, including website advertising, affiliate partnerships, and data sales.

2. House of Brands

This approach minimizes overheads (such as customer service costs), creates supply-side synergies, and achieves scale through a single company offering a range of distinct brands targeting different consumer segments. Essentially, it is the digital equivalent of an FMCG brand company such as P&G or Unilever, with leaders including Thrasio in the US and India’s Mensa Brands, which achieved unicorn status in under a year. Success requires careful management and coordination to maintain each brand’s unique identity and positioning while achieving synergies. Figure 3 provides more details on Thrasio’s approach.

3. Hyperlocal channels

Hyperlocal brands focus on serving a specific geographic area, typically within a few miles, to provide personalized and community-oriented products or services, from food and grocery to laundry. They deliver products ultra-quickly and use data to understand and meet the needs of their customers. Currently many of these brands (such as Deliveroo, Instamart, and TaskRabbit) are investing heavily to improve their efficiency and scale services to meet a market predicted to reach USD4,681.3 million by 2030 from USD1,344.7 million in 2021.

4. Curated marketplace

To expand their reach and leverage their customer base, many challenger brands are creating their own curated marketplaces. These enable other brands to sell their products, attracting more regular visitors and diversifying revenues. For example, shoe company Allbirds has added a commission-free marketplace to its site, offering customers other sustainable fashion products from third-party sellers.

A framework for building and scaling a challenger brand

All start-ups currently face issues around securing funding, as described in How to build a unicorn in the post-pandemic inflationary world (Prism S1 2023). Challenger brands also need to overcome potential market saturation and meet fast-changing consumer requirements. Based on our experience and discussions with brands and investors, we recommend this framework to enable success:

1. Build trust and a strong brand

Social media means feedback is instant and spreads virally. Building trust is crucial for brands, but challenging due to the crowded digital marketplace, lack of physical presence, and limited customer attention span. To create trust, challenger brands should focus on:

-

Developing a clear brand identity that reflects their values and mission to differentiate from rivals

-

Providing excellent customer service to build trust and loyalty

-

Engaging with customers regularly through digital platforms to build community and address negative comments

-

Leveraging influencers and partnerships to reach a wider audience and build credibility

For example, Indian beauty products brand Sugar builds strong trust with millennials by offering make-up products with colors suited to the Indian skin tone that can last a full day in the country’s tropical climate.

“Being vocal about the company’s story and purpose is crucial in building consumer trust and avoiding price competition,” Founder, personal care D2C challenger brand

2. Be data driven without compromising security and data privacy

Consumers are increasingly concerned about how their personal data is being used, and want to do business with companies that take their privacy seriously. Brands should follow these data management practices:

-

Collect only necessary data

-

Use secure storage and robust data management practices

-

Obtain explicit consent from consumers around data uses

-

Provide transparency about data collection and usage

-

Regularly review and update security measures

For example, UK clothing brand ASOS has published a clear data privacy policy and achieved ISO 27001 certification to reassure customers.

3. Focus on profitability to overcome the macroeconomic outlook

Many D2C challenger brands benefited from the switch to digital channels and the closure of shops during the pandemic. The partial shift back to physical commerce has increased pressure around profitability. Investors are now more cautious about funding unprofitable growth, leading to brands pulling out of certain geographic areas. Digital-first brands therefore need to:

-

Focus on profitability rather than simply user acquisition

-

Create sustainable revenue streams, deliver operational efficiency, and differentiate their products/services

-

Apply selective growth strategies, focusing on profitable markets/channels rather than rapid expansion at all costs

“Amazon advertising may not be cheap, but it’s still more cost-effective than establishing physical stores or limiting ourselves to our own marketplace,” Founder, consumer electronics challenger brand

4. Stay competitive in markets where barriers to entry are low

Digital-first brands have lower profit margins than traditional retailers, with an average of 4.6 percent versus 11.6 percent, respectively. Increased price competition further hits margins, while low switching costs make it difficult to retain customers. Challenger brands therefore should:

-

Create a unique value proposition

-

Build a strong brand identity and messaging

-

Leverage technology to improve the customer experience

-

Collaborate to build new revenue streams

-

Continuously innovate and evolve their offering

“Contract manufacturing and transitioning to organized retail allowed us to invest in brand building and expand into different regions,” Founder, personal care D2C challenger brand

5. Focus on innovation and agility

In a volatile world, brands must be flexible and respond to changes in customer preferences to remain competitive. Owning R&D of products gives the brand flexibility to innovate and develop unique products quickly. For example, mCaffeine, a coffee-based beauty products brand from India, owns its product R&D and launches innovative products regularly. Social media platforms frequently introduce new features or algorithms, requiring brands to quickly adapt their digital marketing strategies, while consumer preferences can change overnight. Brands therefore need to:

-

Be data driven and pivot quickly, such as by opening physical stores

-

Own product R&D and embrace a culture of experimentation

“We prioritize using a launch-and-test approach over aiming for a perfect product from the start,“ Founder, challenger coffee brand

6. Ensure a consistent user experience across all touchpoints

As brands expand, inconsistency across touchpoints can lead to customer confusion and erode trust. This is a particular issue as companies rapidly add different channels, platforms, and markets while still being small in terms of size/employees. To mitigate this issue, challenger brands must:

-

Establish a consistent brand identity across all touchpoints

-

Align messaging and branding with target audiences

-

Provide a consistent user experience across all touchpoints

-

Train employees on brand values and ensure they can seamlessly convey them to customers

“As investors, we look for if the brand has ethos in its product development around uniqueness, scalability, and efficaciousness,” Managing Partner, Amicus Capital

7. Adopt new tactics to scale beyond tier 1 markets

Tier 1 cities provide a combination of savvy consumers, straightforward logistics, and digital infrastructure, making them the traditional starting point for challenger brands. However, they are now saturated and highly competitive, meaning brands need to scale beyond them and embrace smaller/emerging markets. This means overcoming challenges such as limited access to digital devices and internet connectivity, lack of trust in online transactions, and concerns around security. Brands therefore must:

-

Launch targeted marketing campaigns to address the concerns and needs of consumers in tier 2/tier 3 cities

-

Adapt business models and offerings to cater to local preferences and go omnichannel. For example, Harry’s Razors moved from being solely D2C to selling in Target (US) and Boots (UK), while FabIndia opened physical stores, especially in tier 2/3 cities

-

Provide more flexible payment and delivery options, such as cash on delivery and pickup points

-

Partner with local businesses and influencers to build credibility with consumers

-

Invest in digital infrastructure and logistics to overcome operational challenges

“Most of the companies in our portfolio are witnessing massive growth from tier 2 cities, showcasing the need to focus on such underserved market segments,” Managing Partner, Amicus Capital

Insights for the executive

For larger brand houses

-

Create your own digital brands: Create your own digital-first brand to launch new and innovative products, and aim to occupy white spaces in the landscape.

-

Partner with challenger brands: Partner with challenger brands to create ecosystem synergies and benefits from respective competencies.

-

Invest through corporate venture capital (CVC): Set up a CVC arm to invest in upcoming challenger brands.

-

Launch a sandbox for fostering innovation: Identify and build in relevant categories that will benefit the parent brand.

For investors

-

Set up dedicated expert teams for building challenger brands: Develop novel themes for investment and provide guidance on business model innovations and opportunities.

-

Establish accelerator programs: Set up accelerator programs to incubate early-stage start-ups.